In Papua New Guinea, most financial institutions prioritise profits over people. NCSL Savings and Loan takes a different approach. As a not- for-profit, member-owned society, NCSL must make a profit too to pay for its operations and invest in the further improvement of its

services. However, a portion of NCSL’s annual profit is returned to all members as annual interest deposited on the general savings account.

Savings

Save with or a purpose or just for a rainy day

Saving for school fees, home improvements, or a family emergency becomes easier with NCSL. Members enjoy simple, hassle-free savings with no hidden charges or account-keeping fees taking away from what they’ve worked hard to put aside. With a choice of savings products and competitive interest rates from 2% to 6% per annum, NCSL helps you grow your money faster while building a strong and consistent savings habit.

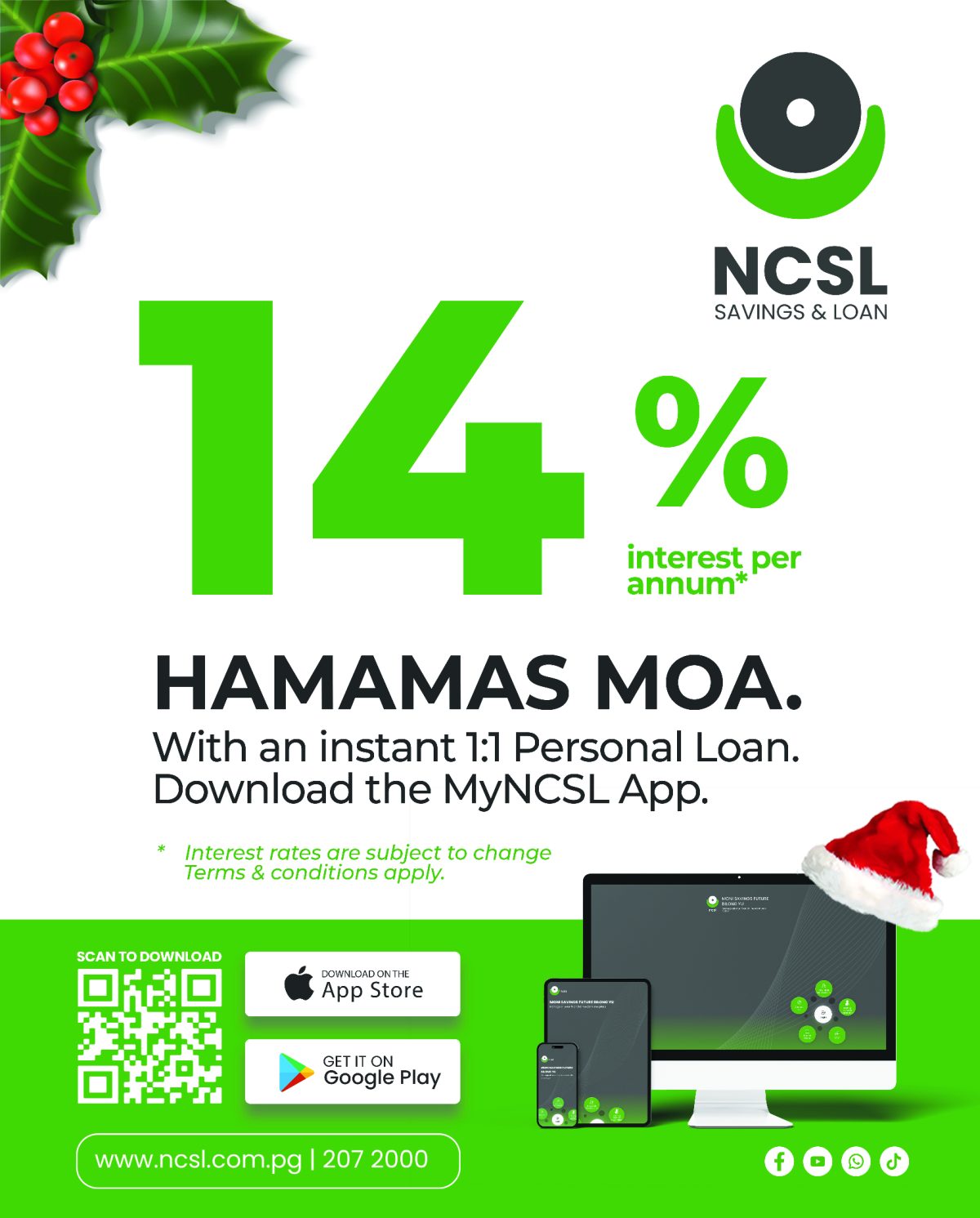

Lending

Fair, Transparent and Responsible Lending

As an NCSL member, your savings open the door to affordable personal loans you can use for any purpose. With interest rates starting from just 14% per annum, you get access to one of the most

cost-effective loan options available

For example, at 14% per annum, you repay the loan AFFORDABLY on the reducing balance each

month

| Loan Amount | Repayment | Term |

|---|---|---|

| K500 | K39.83 | 6 months |

| K1,000 | K41.22 | 12 months |

Unlike many lenders, NCSL also allows you to borrow without touching your savings, so your balance continues earning interest while you meet your immediate needs. It’s a smart way to stay financially

secure.

Convenient Digital Services

For busy people, NCSL’s MyNCSL Member Online allows members to manage their accounts

anytime, anywhere. Services include:

- Withdrawals and transfers between NCSL accounts or to commercial banks

- Viewing balances and downloading statements

- Applying for loans online

These digital services make managing finances simple. No queues, no transport hassles, and no risk of carrying cash on the streets. Just fast, secure and convenient access to your money whenever you need it.

A Society Built on Members’ Interests

Saving with NCSL gives you more than just a safe place to keep your money—it helps you build real financial security. With competitive savings interest and access to affordable loans when you need them, NCSL supports you in planning ahead, reaching your goals, and creating a stronger future for yourself and your family