Joining NCSL Savings and Loan isn’t just about opening a savings account—it’s about becoming

part of something bigger. As a member, you become a shareholder, giving you the right to

access some of the best financial services available in Papua New Guinea.

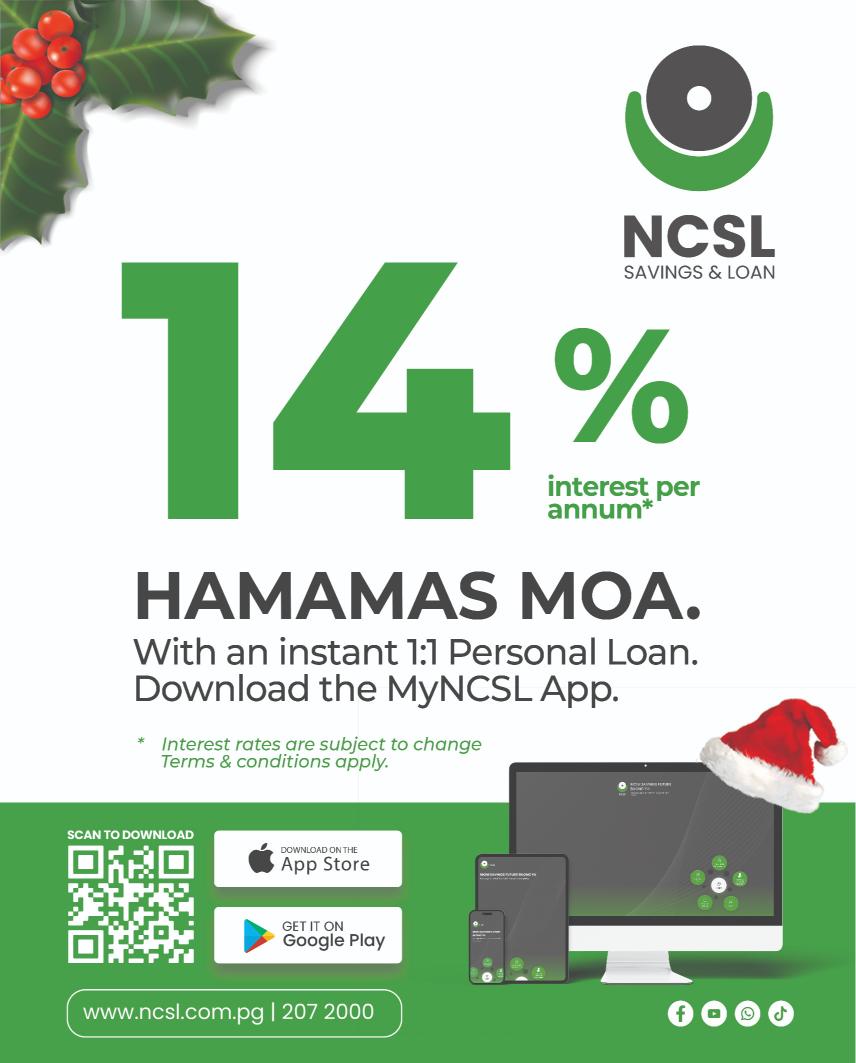

Enjoy easy and convenient access to savings and loan products with competitive rates through

any of our 20 branches nationwide, online via our website, or directly from your mobile

phone—anytime, anywhere.

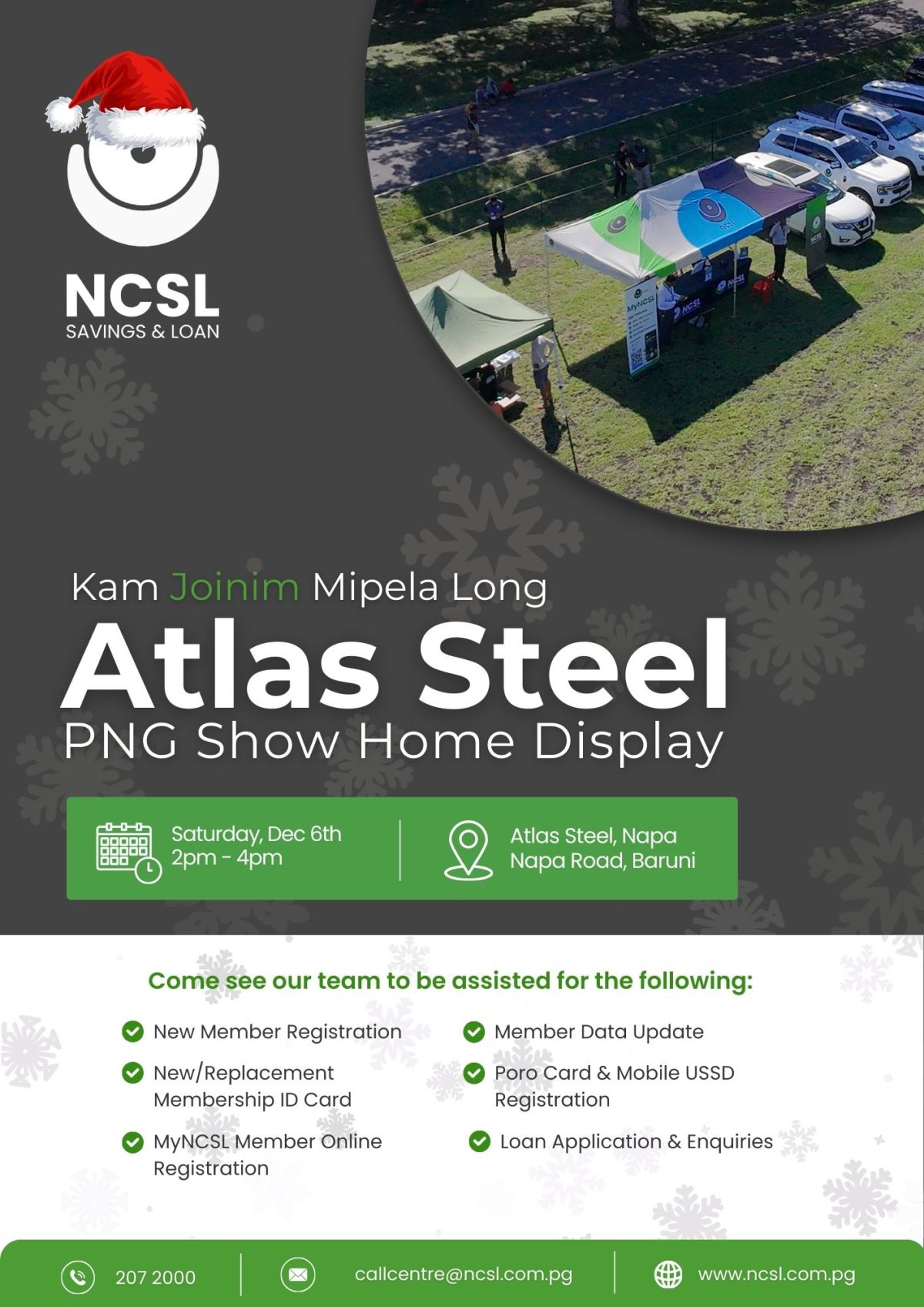

We are continuously working to enhance our services and provide informative presentations to

help you choose the products that best suit the needs of you and your family.

Over the 22 years, we have assisted countless members meeting everyday needs to achieving

goals.

Here we featured some of the testimonials from our members.

Mary – Catholic Bishop Conference PNG & Solomon Islands

“I have been a member with NCSL for 13 years and my savings with NCSL especially General and

Education savings has enabled me to pay for my children’s school fees over the years”

Caroline – Airways Hotel

“Through the support of the payroll team of my employer, I have been contributing to my

savings account as a NCSL member for 8 years. I have been using my interest earned savings to

fund my holidays trips back to my home village during the festive period.”

Wayne – ExxonMobil

“Through NCSL’s 1:5 loan product—which allows members to borrow up to five times the value

of their savings—I was able to purchase a Toyota Harrier SUV in July 2022 and pay nearly

K12,000 in school fees for my son. These achievements have significantly supported both my

personal and family needs.”

Esther – WaterPNG

“My savings with NCSL has been my lifeline assisting me with my medical bills. I have been a

member with NCSL for 6 years now.”

Edith – Aviat Club

“I am a member with NCSL since 2007. My savings have grown over the years and I have used to

attend to customary obligations, family needs and build myself a house.”

Thanks to our members

It is because of our members that we have grown, evolved and innovated achieving

transformative milestones. As we reflect on our 22-year journey, we are humbled by the

milestones we’ve achieved as each one is a testament to the trust and growth shared with our

members;

• 2005: Introduced Discount Program for Members

• 2010: SaveBal Service launched

• 2016: Biometric Identification System Introduced

• 2017: NCSL Constitution amended to open membership to open to non-Nasfund members (public)

• 2015: Online Services introduced

• 2019: Poro Card & EFTPoS introduced. First non-bank financial institution to participate in retail electronic payment system

• 2020: Introduction of Higher ratio Loans. NCSL rebrands with facelift of new logo.

• Introduction of Higher Ratio loan.

• 2022: Rolled out Wokabaut Tablets to register new members instantly at employer sites

• 2023: New Call Centre Established at NCSL Head Office

• 2024: Implemented a new system. Introduced enhanced version of MyNCSL Member Online and YourNCSL Employer Online

Over time, NCSL has become more than a financial institution. It became a partner in progress, a

source of stability, and a symbol of empowerment through financial literacy training, focussing

on creating a savings culture and responsible lending. Members feel noticed, supported, and

valued. Not just for what they save, but for who they are and what they aspire to achieve within

their respective families, clan, tribe and modern-day community

In celebrating 22 years, NCSL isn’t just marking time, it’s honouring any of the 160 000 of life

journeys we have helped shape. And for every member, our journey together continues.

“NCSL exists because of our members — they are the foundation of everything we do. Our

purpose is to serve them with integrity, innovation, and care, ensuring their financial wellbeing

remains at the heart of every decision we make.” Said CEO Frans Kootte.

From humble beginnings NCSL’s history is a living testament of our journey with our loyal

contributors.